In banking, there are several types of cheques that can be used for different purposes. Here are some common types of cheques:

Bearer Cheque: This type of cheque is payable to the bearer, i.e., the person who possesses the cheque. It can be encashed by anyone who presents it to the bank, regardless of whether they are the named payee or not. Bearer cheques are considered less secure and are less commonly used nowadays.

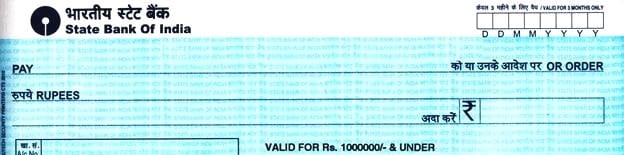

Order Cheque: An order cheque is payable to a specific person or entity named in the cheque. Only the named payee or an authorized representative can encash or deposit the cheque. This type of cheque is more secure than a bearer cheque and is widely used.

Crossed Cheque: A crossed cheque is one where two parallel lines are drawn across the face of the cheque. It indicates that the cheque can only be deposited into a bank account and cannot be encashed over the counter. This adds an extra layer of security and reduces the risk of the cheque being fraudulently misused.

Open Cheque: An open cheque is not crossed or marked in any specific way. It can be encashed by the bearer over the counter at the bank. Open cheques are generally less secure, as they can be easily misused if lost or stolen.

Post-dated Cheque: A post-dated cheque is one where the date written on the cheque is a future date. The cheque cannot be encashed until that specified future date arrives. This is commonly used for future-dated payments or to secure a payment at a later time.

Self Cheque: A self cheque is written by an account holder and made payable to themselves. It is commonly used for withdrawing cash from one’s own bank account or for transferring funds between one’s own accounts within the same bank.

Banker’s Cheque: A banker’s cheque, also known as a cashier’s cheque or a bank draft, is issued by the bank itself. It is drawn on the bank’s own account and is guaranteed by the bank. Banker’s cheques are often used for large transactions or when a secure form of payment is required.

It’s important to note that the availability and usage of specific types of cheques may vary across different countries and banking systems. It’s always advisable to consult with your bank or financial institution for specific details regarding cheque types and their usage in your location.